In the competitive world of enterprise resource planning (ERP), mastering SAP SD Billing Configuration is crucial for a successful SAP consultant. SAP SD Billing Configuration not only streamlines billing operations and enhances accuracy but also ensures seamless integration with other SAP modules.

This guide will walk you through the essential features, best practices, and advanced techniques to help you harness the full potential of SAP SD Billing Configuration. Whether we are a seasoned SAP consultant or a new SAP consultant, this comprehensive overview will equip you with the knowledge to improve efficiency and drive success in your organization.

Table of Contents

1. Important fields in Billing Type Configuration

Let’s have a look on all the important fields of billing type.

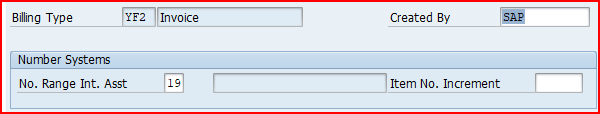

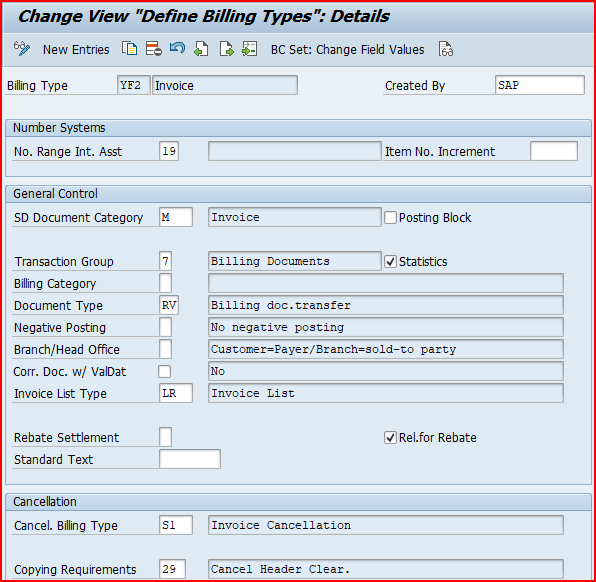

We have configured billing type YF2 for our car business.

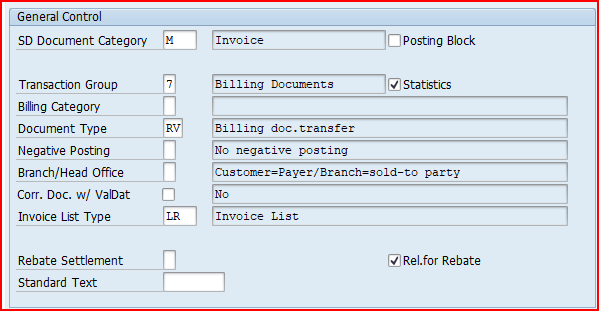

1.1 Fields in the “General Control” Section

- Transaction group : A group that allows you to control certain features of transaction flows by sales, shipping and billing documents.

- Billing category : It is used to differentiate the billing documents.

- Document type : This field classifies accounting documents. As invoice generates FI document type RV (Billing data transfer)

- Negative posting : Negative posting for same period.

- Branch/Head office: The indicator controls, which partner functions of the billing document, can be forwarded to financial accounting.

- Credit memo with value date : If the field is set, the reference billing document is not settled and the payment deadline date for the base billing document comes after the billing date for the credit memo.

- Invoice list : Classification that distinguishes between invoice list types that require different processing by the system.

- Posting block: it blocks automatic transfer of the data from invoice to FI document. Invoice has to be released manually then.

- Statistics: the value of the billing document is going to be updated in LIS. It indicates whether the system stores information from billing documents for the purposes of statistical analysis.

- Rebate settlement : If indicates whether the billing type is used exclusively during rebate processing.

- Relevant for Rebate: This indicator is one of the pre – requisite to process rebates.

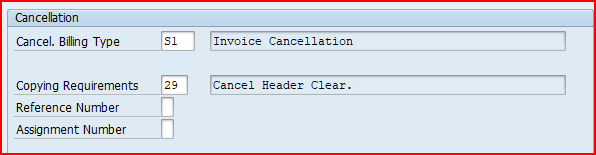

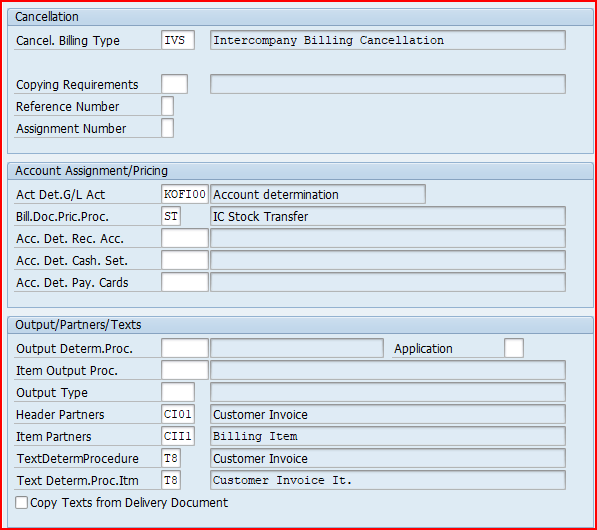

1.2 Fields in the “Cancellation” Section

- Cancellation billing type : It specifies the default cancellation for this billing type.

- Copying requirements : The routine checks that certain requirements are met when one document is copied into another.

- Reference number : The reference number is a piece of additional information forwarded from SD and FI.

- Allocation number : item that is forwarded from SD to FI. If you do not make an entry and the field is not filled in the order, the field remains empty.

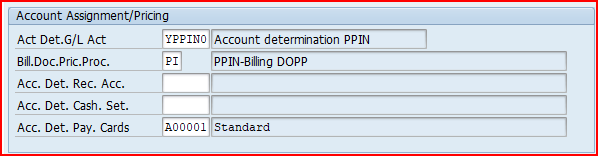

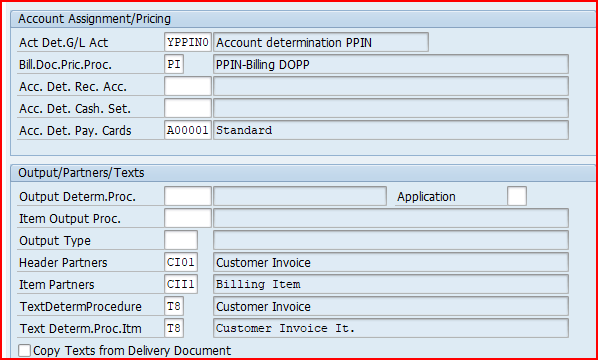

1.3 Fields in the “Account Assignment/Pricing” Section

- Account determination procedure: It specifies the condition types that the system uses for a particular type of document (Ex: Invoice) to determine the G/L Accounts to which amounts should be posted.

- Document pricing procedure : The key that specifies the pricing procedure for this type of sales document. The pricing procedure determines how the system carries out pricing for a particular sales document.

- Account determination reconciliation account: If a G/L Account is determined here, then the reconciliation account stored in the customer master record is ignored.

- Account determination cash settlement : It determines the condition types that the system uses to determine G/L Account for cash settlement. If this field is filled, then the billing document is not posted on the debit side. In this case the G/L Account determined is posted.

- Account determination pay cards : It specifies the condition types that the system uses to determine general ledger accounts for document types used in payment card transactions.

We will configure our own billing type “YF2” as shown in the below screenshots.

Note

Once we have configured our own Account determination procedure. We will assign this to the billing type YF2

Please check below post to have a step by step overview of the Account determination procedure

SAP SD FI Integration and Account Determination

2. Billing Type Configuration

We define the billing type here for the different business scenarios.

We define the billing type first here and then it is inputted in sales order type.

2.1 Billing Type for Standard Sales Order

For standard order we use billing type as F2.

For our car business we have copied and configured our specific billing type as YF2

To configure billing type follow the below path

SPRO –> Sales and Distribution –> Billing –> Billing Documents –> Define Billing Types for Sales

Alternatively use transaction code VOFA

Configure billing type YF2 as shown in the below screenshot

Now to determine this billing type based on a delivery or order , we need to input this delivery type in the sales document type.

Please check the below post to see the assignment of delivery type YF2

Configure SAP S4 HANA Sales Documents in 10 Minutes – Assignment of Delivery Type & Billing Type to Sales order Type

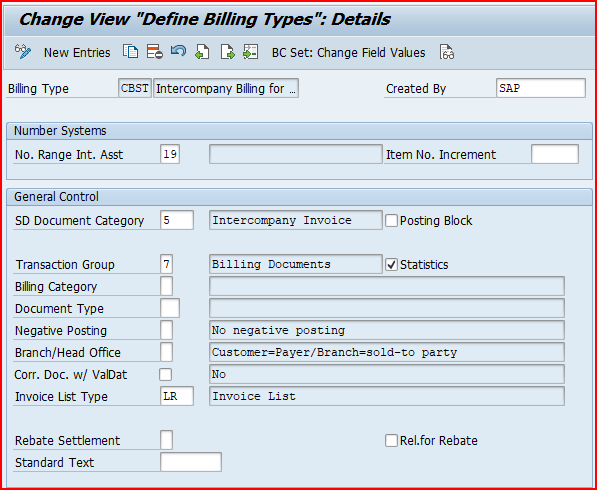

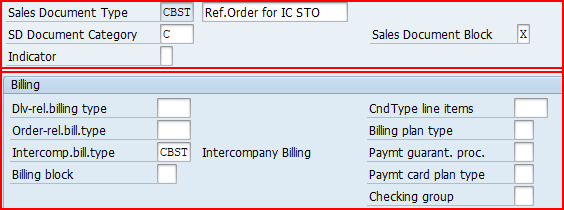

2.2 Billing Type for Inter-Company STO

For inter-company STO with delivery & billing, we use reference sales document type as CBST as shown in the below heading HERE

Configure the billing type CBST as shown in the below screenshot

2.2.1 Reference sales Order type for Inter-company STO with Delivery & Billing

We use Reference sales Order type “CBST Ref.Order for IC STO” for Inter-company STO with Delivery & Billing

We assign billing type “CBST” to reference sales Order type “CBST” as given in the below screenshot.

3. Billing Copying Control

Here we Configure data copy from billable reference documents to billing documents.

There are three copying control scenarios related to the billing

- Sales document to billing document

- Delivery to billing document

- Billing document to billing document

We will configure each scenario one by one

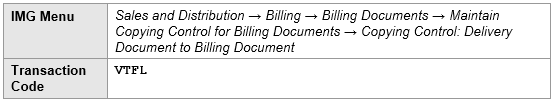

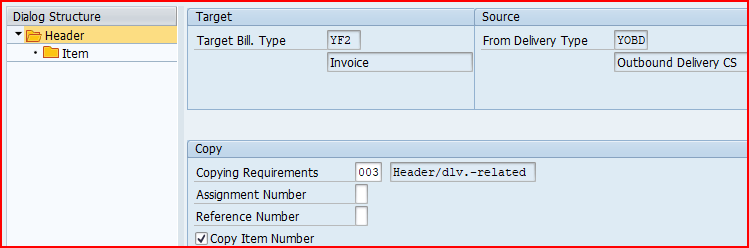

3.1 Copy Control from Delivery Document to Billing Document

We will set up copy control from delivery document to billing document. This is used in several scenarios like standard sales process & third party with individual PO process

Follow the below path for this

3.1.1 Scenario 1 : Standard Sales Scenario

In the standard sales scenario we configure the copy control from std outbound delivery to standard billing

Here we make specifications for copying requirements, transferring data & quantity and value updates in document flow. We will do this for each copying pair at header and item level.

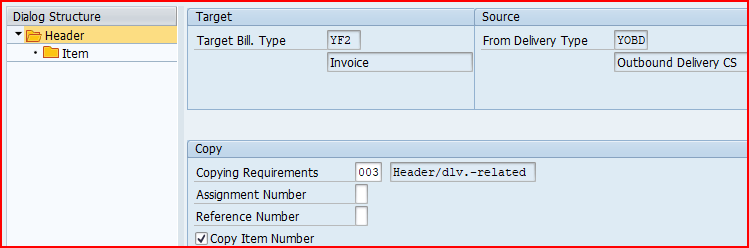

First we will copy Header Data

a) Header Data Copy

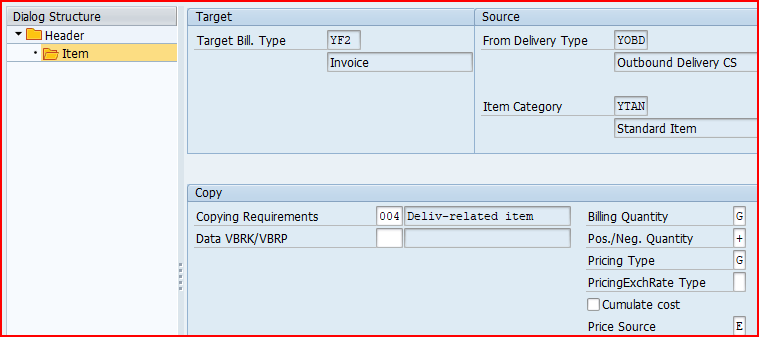

Our Delivery type is “YOBD” & billing type is “YF2”

b) Item Data Copy

Click on Item and configure the copy control at item level

c) Characteristics of scenario 1 Copy Control

Below are the main Characteristics of the above configuration

- Billing Quantity “G” means billing will be generated for Cumulative batch quantity minus invoiced quantity

- Price Source “E” means Source is “Delivery/Order”

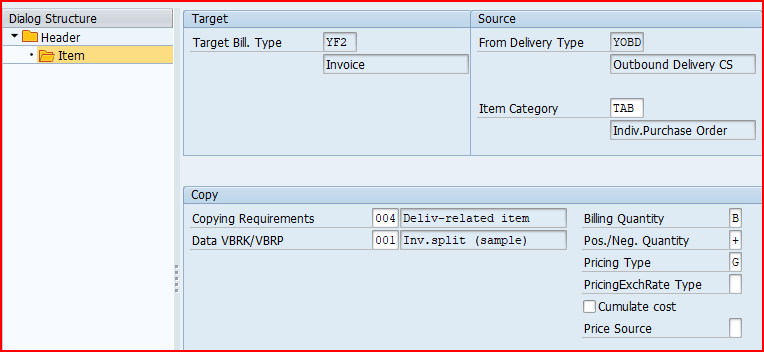

3.1.2 Scenario 2 : Third Party Sales with Individual PO

In the Third Party Sales with Individual PO scenario we maintain “A” for billing relevance in the corresponding item category “TAB”. we configure the copy control from std outbound delivery to standard billing.

Value “A” in the billing relevance field of sales order item category indicates that the billing document is created based on the delivery. Hence we need to configure copy control from delivery to the billing for Third Party Sales with Individual PO scenario

Please see the below post for Item Category “TAB” configuration

Mastering SAP Sales Item Categories: A Comprehensive Guide – Item Category for 3rd Party sales with individual PO “TAB

First we will copy Header Data

a) Header Data Copy

Our Delivery type is “YOBD” & billing type is “YF2”

b) Item Data Copy

Click on Item and configure the copy control at item level and configure for item category “TAB”

c) Characteristics of scenario 2 Copy Control

Below are the main Characteristics of the above configuration

- Billing Quantity “B” means billing will be generated for Cumulative delivery quantity minus invoiced quantity

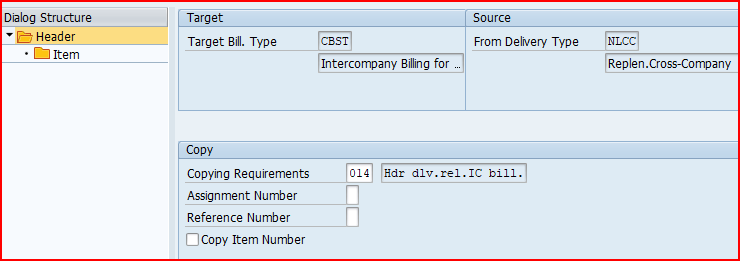

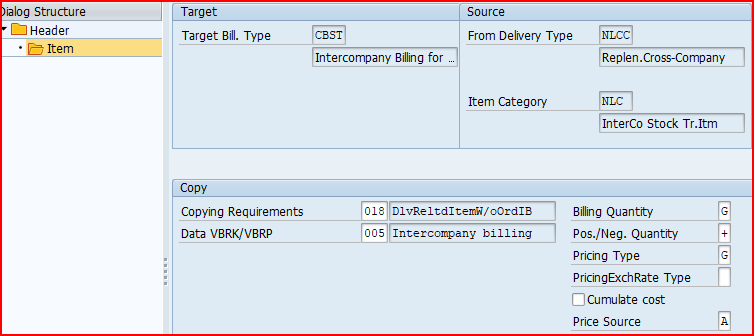

3.1.3 Scenario 3 : Inter-Company STO with Delivery & Billing

For scenario “Inter-Company STO with Delivery & Billing”, we use delivery type as “NLCC” & Billing type as “CBST”

We will first configure the copy control for Header & the item

a) Header Data Copy

We will configure Header data copy from source document type “NLCC” to target Document type “CBST”

a) Item Data Copy

For scenario “Inter-Company STO with Delivery & Billing”, we use delivery type as “NLCC” with item category as “NLC”

So we will maintain the item data copy for Item category “NLC”

Billing quantity “G” indicates – Cumulative batch quantity minus invoiced quantity.

Pricing type “G” indicates to copy price elements unchanged and redetermine taxes.

Price source is “A” – Purchase Order

3.2 Copy Control from Sales Document to Billing Document

We will configure copy control from the sales document to Billing document for the third party sales processing

In the third party Order processing , our business outsource the final product to a third party to sell it to customer.

Upon receiving third party order order from the customer, we passes it to the third party vendor who delivers the goods to the customer, and invoice to our business. Then we bills the customer for the goods supplied.

Once invoice receipt is entered, we can bill the customer.

--> Since an outbound delivery doesn’t exist for the third-party, the billing will be sales order based. In the item category configuration, the billing relevance indicator is set to "F". So the system allows invoicing the order only when vendor’s invoice has been processed in invoice verification.

Please check the detail step by step end to end third party process in the below post

The Ultimate Guide to SAP Third Party Sales

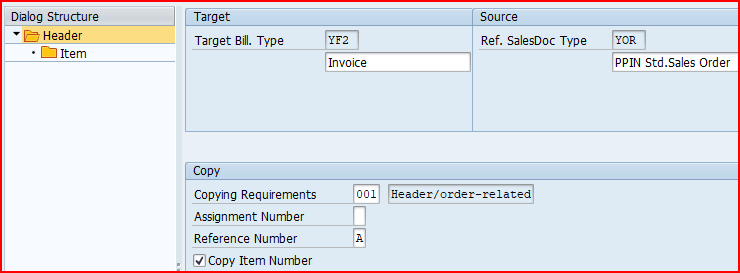

a) Header Data Copy

Our Sales Order type is “YOR” & Billing Type is “YF2”

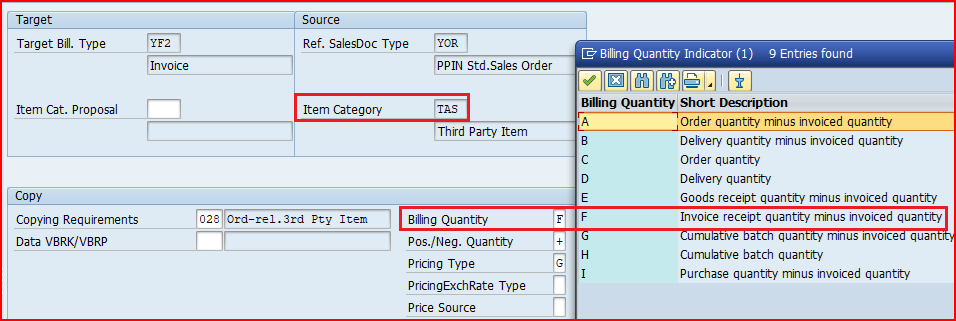

b) Item Data Copy

Click on Item and configure the copy control at item level

The Billing is created for the quantity specified in the vendor invoice. The setting in the copy control for the third-party item category (TAS) from sales document (YOR) to billing document (YF2) specifies that the quantity from the invoice receipt is transferred to the billing document instead of the order quantity (billing quantity indicator in copy control is F)

Please see the below post for Item Category “TAS” configuration

Mastering SAP Sales Item Categories: A Comprehensive Guide – Item Category for 3rd Party sales “TAS”

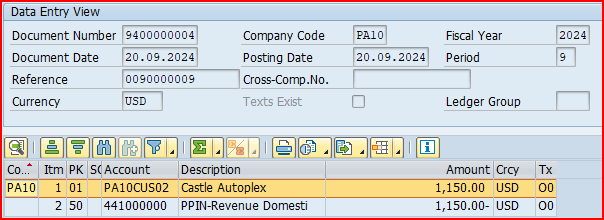

4. Posting of Billing Documents

We will now post billing documents for all the sales scenarios. Accounting document is generated as a result of the billing document posting

Billing can be posted to customer based on a sales order on based on a delivery depending upon the business scenario.

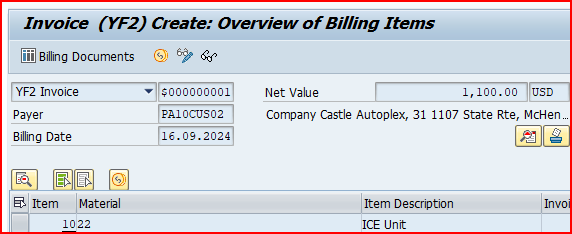

4.1 Billing for Standard Sales Scenario

In standard sales scenario, the process begins with creating a sales order based on a customer’s purchase order, followed by an availability check.

Once sales order is confirmed, a delivery document is generated, and the goods are picked, packed, and shipped, updating the inventory. Then we can create billing document to customer.

Note : Please visit the below post for details of sales order & delivery creation which is a prerequisite for billing document creation

An Ultimate guide to Sales Order in SAP S4 HANA SD – Standard Sales Order

As described in the delivery item copy control for standard scenario HERE, the billing would be generated for the order item (as no invoice is created till yet).

Start VF01 and input outbound delivery number

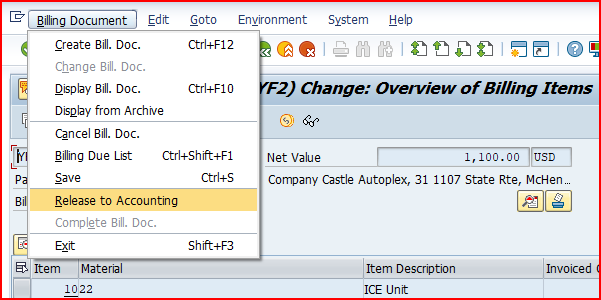

Save and click on “Release to Accounting”.

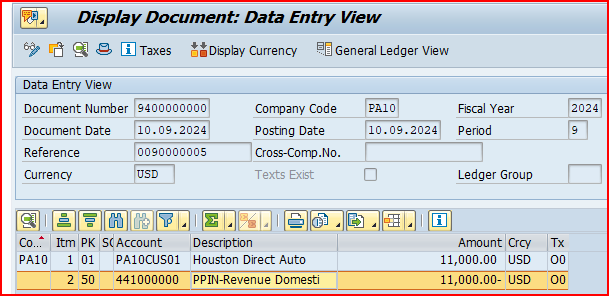

This will generate a accounting document as shown below

Note: Please visit the below post for account assignment configuration (SD-FI Integration) details

SAP SD FI Integration and Account Determination

4.2 Billing for Third Party Sales Scenario

In the third party Order processing , business outsource the final product to a third party to sell it to customer.

4.2.1 Prerequisite for third party sales scenario billing creation

Below are the prerequisite for the billing creation for third party sales scenario

- Sales Order to Customer created

- PR & PO to vendor created.

- GR can be created

- Vendor invoice is posted

Now we can do the third party sales billing

Note : Please visit the below post for details of end to end third party sales process prerequisite for billing document creation

The Ultimate Guide to SAP Third Party Sales

Since for our third party item category, billing-relevance indicator F is activated billing refers to the goods receipt quantity instead of the incoming invoice quantity

Start VF01 and input outbound delivery number

Save and click on “Release to Accounting”.

This will generate a accounting document as shown below

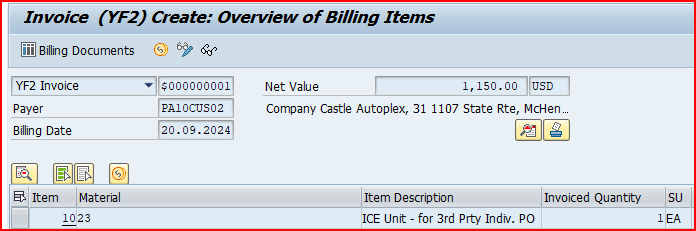

4.3 Billing for Third Party Sales with Individual PO Scenario

In the third party Order processing , business outsource the final product to a third party to sell it to customer.

4.3.1 Prerequisite for Billing creation

Below are the prerequisite for the billing creation for Third Party Sales with Individual PO scenario.

- Sales Order to Customer created

- PR & PO to vendor created.

- GR is created

- Vendor invoice is posted

- Outbound Delivery to Customer based on sales order is created and Pick, Pack & Goods issue is done.

Now we can do the third party sales with individual PO billing

Note : Please visit the below post for details of end to end third party sales process prerequisite for billing document creation

Third Party Sales with Individual Purchase Order

Start VF01 and input outbound delivery number

Save and click on “Release to Accounting”.

This will generate a accounting document as shown below