In this post we will unlock the complexities of accounting entries in the SAP Intercompany STO Process with Delivery & Billing with this comprehensive guide.

We will discover the accounting entries for both moving average price (MAP) and standard price materials.

--> This post is to explain the accounting entries in the SAP Intercompany STO Process with Delivery & Billing

--> To check the details of configuration & testing of "SAP Intercompany STO Process with Delivery & Billing", please check the below post

How to Configure SAP Intercompany STO Process with Delivery & Billing

Table of Contents

1. Components of the intercompany STO Accounting

The business scenario for “SAP Intercompany STO Process with Delivery & Billing” involves two separate company codes within the same corporate group.

Plant PP10 orders 1 PC of a material from plant PA10.

The system uses the following prices:

- Valuation price of material (Plant PA10): $1000

- Order price (Plant PP10): $1060

- Price for intercompany billing (Plant PA10): $1071

To understand easily, Prices are given in the pictorial form below

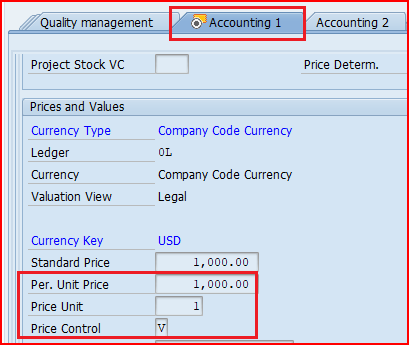

1.1 Material Valuation in Supplying Plant

Material valuation in the supplying plant is picked up from the material master data

As shown above, We have set it at $1000 at Moving Average Price (MAP)

Check the price in MM03 “Accounting View”

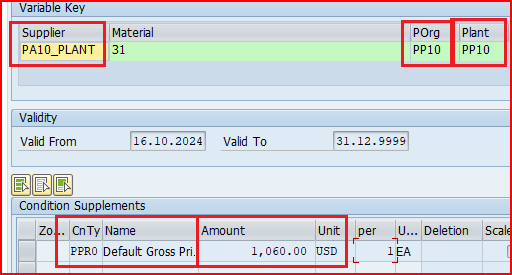

1.2 STO Order Price

Order price is determined through info records in the ordering plant (PP10) for the supplying vendor (PA10_PLANT) in the ordering plant Purchasing Organization (PP10).

To maintain the same, start ME11 and input the data as stated above

Input the ordering price as $1160

--> As soon as we input intercompany Price in the STO, This PPR0 value becomes inactive as explained HERE

1.3 Intercompany Price

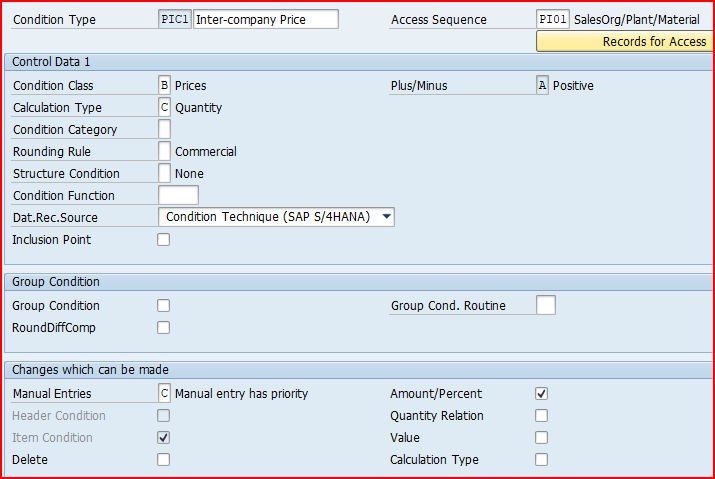

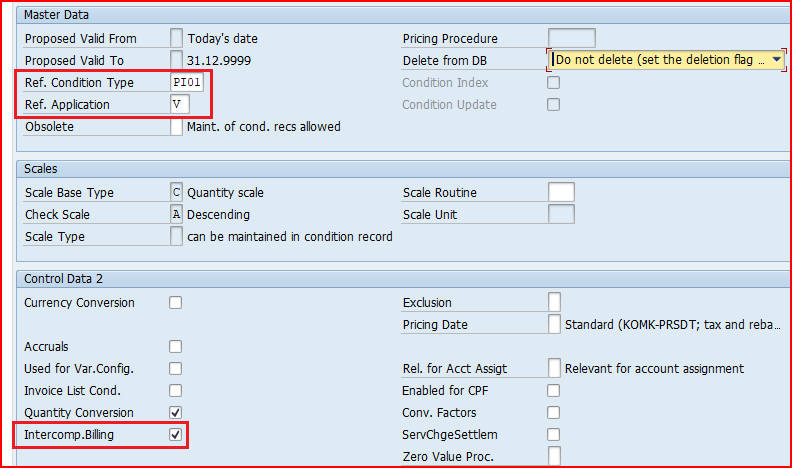

To calculate the intercompany Price in the SAP Intercompany STO Process with Delivery & Billing, we use condition type PI01 & PIC1

1.3.1 Condition Type PI01

PI01 represents the intercompany base price or the cost price to transfer the material between the two company codes.

Intercompany base price is crucial because it forms the foundational value for pricing the material in the intercompany transactions.

--> The price derived from PI01 is set at the supplying plant's cost of goods or the agreed price for the goods being transferred to the receiving company code.

--> Intercompany conditions are usually statistical in the sales order/customer invoice but not statistical in the intercompany invoice.

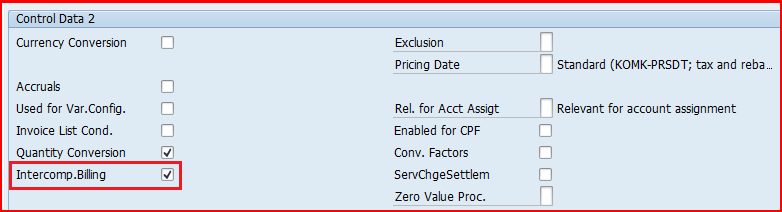

1.3.2 Condition Type PIC1

The purpose of PIC1 is to ensure the selling company (the supplying plant) reflects a profit in its books from the intercompany sale.

PIC1 helps to adhere to transfer pricing policies often required for financial and tax reporting in multinational corporations.

--> When the billing is generated for the intercompany STO, PIC1 condition type determines the total amount to be billed from the supplying company to the receiving company.

PIC1 refers to PI01 to determine the transfer price.

1.3.3 Intercompany Price Determination

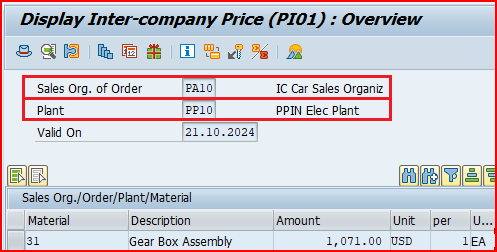

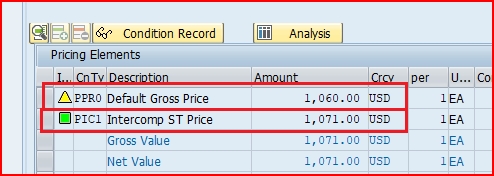

To determine the intercompany price start VK11

--> Intercompany price condition records are created based on sales organization of Order (PA10) & Receiving plant

Input the sales organization of order (PA10) & Ordering plant (PP10) along with intercompany prices $1071, and save the entries

Since condition type used in the intercompany STO PIC1 refers to the PI01 so maintaining PI01 through VK11 will automatically set the value of PIC1 in the corresponding Intercompany STO.

1.3.4 Intercompany Price Condition PIC1 in Intercompany STO

As soon as PIC1 is activated through condition record as explained above, system makes main condition type PPR0 inactive.

2. Accounting Integration Points in the SAP Intercompany STO with Delivery & Billing Process.

in SAP Intercompany STO Process with Delivery & Billing , there are four FI integration points

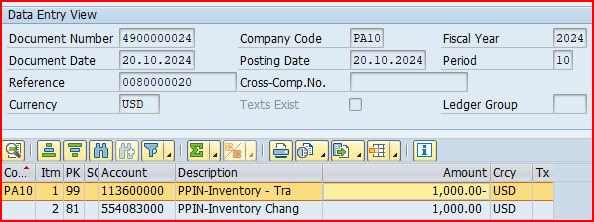

2.1 Accounting Integration at Goods Issue in the sending Plant

At the time of goods issue in the sending plant , accounting integration happens.

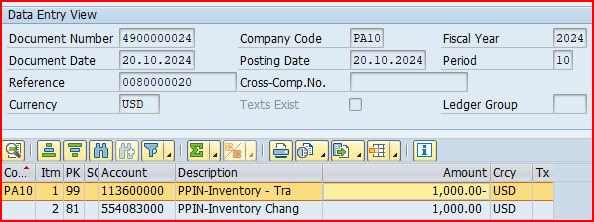

Below are the accounting entries at the time of Goods Issue in the sending Plant.

Debit (+) – Stock Account (Sending Company Code)

Credit (-) – Inventory Change Account (Sending Company Code)

For the above , Value is taken from Material Master as explained in Heading 1.1 Material Valuation in Supplying Plant

2.2 Accounting Integration at Goods Receipt in Receiving Plant

At the time of goods receipt in the receiving plant , accounting integration happens.

Below are the accounting entries at the time of Goods receipt in the receiving Plant.

Debit (+) – Stock Account (Receiving Company Code)

Credit (-) – GR/IR Account (Receiving Company Code)

For the above , Value is taken from the intercompany Price as explained in heading 1.3 Intercompany Price

2.2.1 Accounting Integration at Goods Receipt in Receiving Plant with Standard Material Price.

If material price is “S” then in the whole process of SAP Intercompany STO Process with Delivery & Billing, accounting entries are a bit different at the time of Goods Receipt in Receiving Plant

Below are the accounting entries at the time of Goods receipt in the receiving Plant with material price as “Standard” in receiving plant

Material valuation in receiving plant is $1100 and sending plant is sending the material at $1071.

So the gain of $29 will be posted to the Gain in Price variance

Debit (+) – Stock Account (Receiving Company Code)

Credit (-) – GR/IR Account (Receiving Company Code)

Credit (-) – Gain Price Variance Account (Receiving Company Code)

2.3 Accounting Integration at Intercompany Billing

The next accounting integration point is at the time of intercompany billing.

Below are the accounting entries at the time of Intercompany Billing in the sending Plant.

Debit (+) – Customer Account (PP10_CUST , Sending Company Code)

Credit (-) – Domestic Revenue Account (Sending Company Code)

For the above , Value is taken from the intercompany Price as explained in heading 1.3 Intercompany Price

2.4 Accounting Integration at Invoicing

The next accounting integration point is at the time of Invoicing in the receiving plant.

Below are the accounting entries at the time of Invoicing in the receiving plant.

Debit (+) – GR/IR Account (Receiving Company Code)

Credit (-) – Supplier Account (PA10_Plant, Receiving Company Code)

For the above , Value is taken from the intercompany Price as explained in heading 1.3 Intercompany Price

This completes the accounting Entries in the SAP Intercompany STO Process with Delivery & Billing

Pic Courtesy: Freepik | Create great designs, faster